In today’s digital landscape, mortgage brokers are swiftly moving to online advertising to bolster their outreach, optimise lead generation, and elevate their brand’s stature. Ad platforms such as Google, Microsoft, and Facebook Ads have emerged as the preferred choices for most professionals in the sector. This significant shift is not without rationale. The old saying that “people buy houses, not loans” is evolving. Now, people are increasingly starting their home-buying journeys online, seeking knowledge, comparing options, and searching for the right broker to guide them through the intricacies of the mortgage realm.

The Modern Homebuyer: From Traditional Views to Digital Moves

Why this shift, you wonder? The modern homebuyer is digitally astute, often balancing multiple responsibilities and searching for efficient, user-friendly solutions at their fingertips. Traditional marketing channels, whilst still holding merit, can’t provide the immediacy, personalisation, and reach that digital platforms offer. Furthermore, online advertising platforms like Google Ads provide data-driven insights, allowing mortgage brokers to understand their audience better and refine their marketing strategies in real-time.

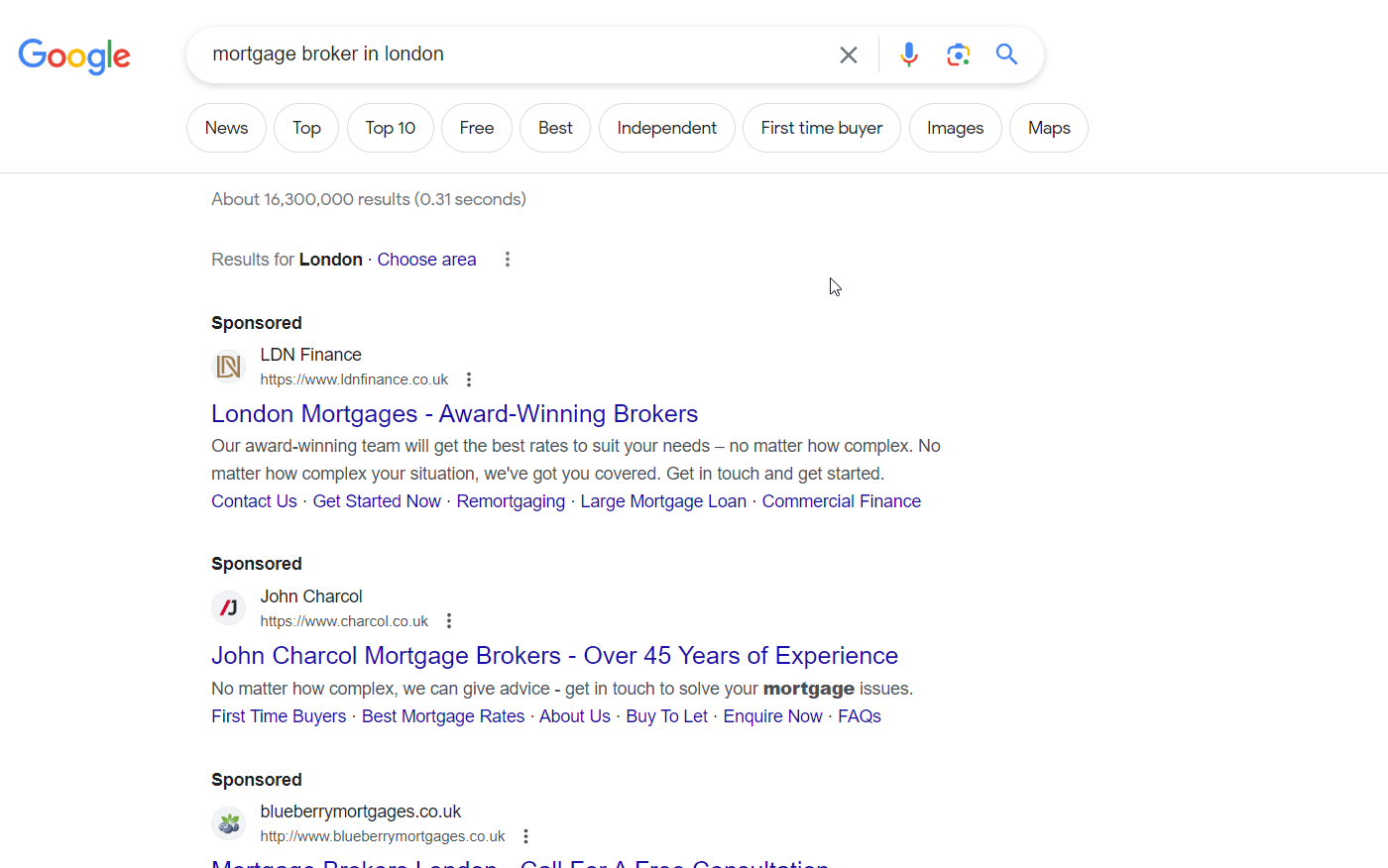

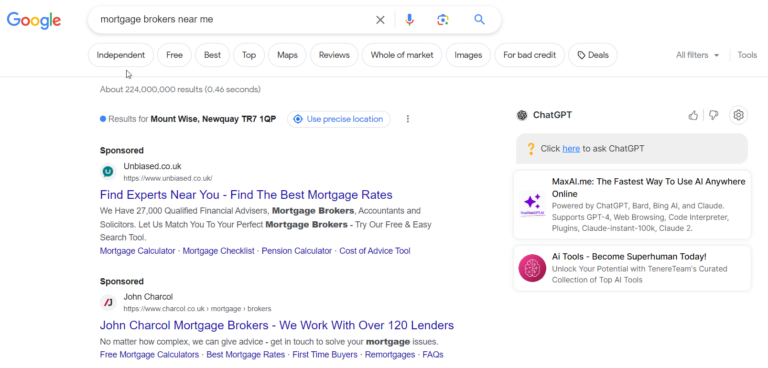

But among the titans of online advertising, why has Google Ads drawn the attention of mortgage brokers so profoundly? Firstly, Google processes over 3.5 billion searches daily. Just ponder the vast number of potential clients searching for mortgage advice, rate comparisons, or broker evaluations. By utilising Google Ads, you’re essentially positioning your services at the vanguard of this immense, active audience.

Moreover, Google’s robust targeting options let brokers hone in on their audience based on various factors such as location, age, browsing behaviour, and even the type of property they’re interested in. Such precise targeting means your ad budget is spent engaging those who are genuinely keen on your services, thus maximising return on investment.

However, as enticing as it sounds, traversing the intricacies of Google Ads necessitates a strategic stance, a profound grasp of the platform, and awareness of the typical pitfalls. Over the forthcoming sections, we’ll probe deeper into the subtleties of setting up triumphant ad campaigns, crafting persuasive ad copy, and refining your strategies to ensure you’re not merely reaching potential clients, but efficiently converting them too.

Demystifying Google Ads for Mortgage Brokers: An In-depth Exploration

At its heart, Google Ads operates on the principle of targeted advertising. This ensures that mortgage brokers can delineate and refine the specific audience they wish to reach, making certain their promotional content is showcased to individuals most inclined towards their services.

By utilising these targeting tools, mortgage brokers can ensure that their ads don’t just gain visibility but resonate with the right audience — those actively in pursuit of mortgage guidance and services

Howver, a vast number of brokers aren’t fully capitalising on the benefits of these advertising campaigns. They grapple with achieving a regular inflow of quality leads without variable costs.

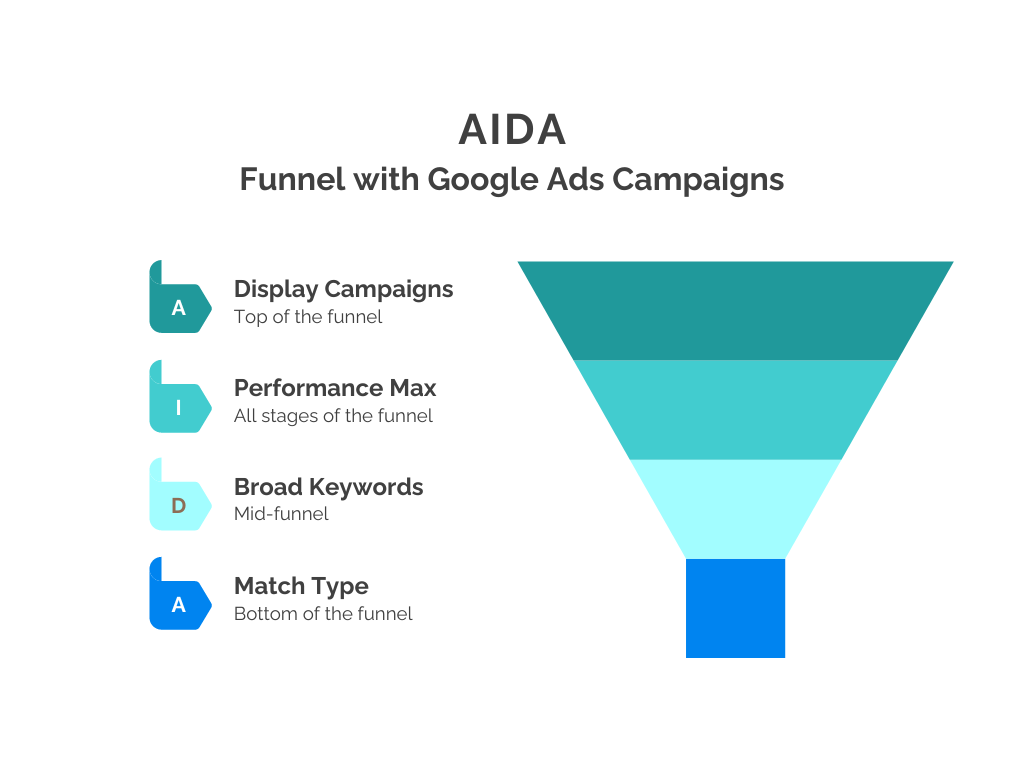

A frequent error is a generic targeting strategy, instead of designing campaigns around a clearly defined Ideal Customer Profile (ICP). Instead of targeting prospects ready for conversion at the bottom of the buying funnel, they cast too high in the funnel. This reduces the number of leads, but also limits the ability to continue scaling advertising profitability.

In this comprehensive guide, we’ll unravel the subtleties of Google Ads, tailored specifically for UK brokers. Our goal? To arm you with practical insights for immediate, measurable results, ensuring a steady stream of first-rate leads that perfectly complement your brokerage offerings. Lets get started!:

Validating Your Mortgage Credentials on Google Ads

Before venturing into advertising on Google Ads, financial service providers must first validate their compliance with the financial regulations of their respective jurisdictions. For instance, in the UK, firms should possess approval from the Financial Conduct Authority (FCA). These protocols are in place to ensure transparency and authenticity, providing internet users with the confidence that they are interacting with certified and approved entities

Targeting (Keywords):

Keywords represent specific words or phrases that potential clients are likely to input into Google when seeking mortgage or remortgage options.

When a user’s search term closely aligns with one of your selected keywords, Google prioritises displaying your ad either above or beneath the organic search results.

A prevalent misstep among advertisers is opting for overly broad keywords that reach a wider audience higher in the buyer purchase funnel. For instance, using “mortgage deals” casts a wider net than the more specific “mortgage advisor”. Choosing “mortgages” over “mortgage advisor” tends to capture users in the initial stages of their journey. In contrast, those searching for a “mortgage advisor” are typically further along in their decision-making process and are actively seeking broker assistance. By honing in on such targeted, bottom-of-the-funnel keywords within the mortgage sector, you enhance your chances of success with Google Ads.

Initially, it’s prudent to concentrate on a limited set of Google Ads keywords. As positive results emerge, you can judiciously expand your campaign. Comprehensive keyword research is instrumental in identifying mortgage-centric terms that are transaction-oriented rather than merely informational. Adopting this strategy not only augments lead generation but also provides a foundation for incrementally increasing your advertising budget in tandem with performance growth.

Delving into Long-Tail Keywords:

Long-tail keywords, such as “mortgages for directors”, often present a more cost-effective approach compared to popular, broader terms like “mortgage broker London”, “mortgage advice”, or simply “mortgage broker”. While these specific, elongated keywords might command a lower search volume, they tend to attract a more qualified audience.

The specificity of a searcher’s term often correlates with their position in the decision-making process. Generally, the more detailed and targeted the search, the closer the user is to the bottom of the keyword funnel. This means they’re more likely to be primed for action, increasing the chances of them making an online enquiry. By integrating long-tail keywords into your strategy, you can capture this decisive, niche audience and potentially enhance your conversion rates.

Decoding Keyword Match Types in Google Ads

Understanding keyword match types is paramount to creating a successful Google Ads campaign. These match types determine when your ad will show based on the search queries users enter. Using the right type can drastically improve your campaign’s precision and cost-efficiency.

Broad Match: This is Google Ads’ default match type, casting the widest net. It captures searches related to your keyword, its variations, synonyms, and more. While it can introduce your ad to a vast audience, it may not always align with your target.

Phrase Match: Represented as “keyword”, phrase match targets queries containing your keyword in the exact sequence you specify, albeit with potential additional words before or after. For instance:- “mortgage for bad credit” (your keyword) can match “get a mortgage for bad credit.”

Exact Match: Enclosed in square brackets like [keyword], this type targets the exact term or very close variants. It’s highly specific, ensuring your ad appears only for the most relevant searches. – [mortgage for bad credit] would match “mortgage for bad credit” but not “get a mortgage for bad credit.”

Strategy Recommendations: Start with phrase and exact match types to hone in on the most relevant, bottom-of-the-funnel traffic. These match types prevent your ad from appearing for unrelated searches, ensuring better lead quality.

As your campaign matures, you can venture into broad match, especially if you’re equipped with a CRM system that integrates with Google Ads to gauge lead quality, such as tracking which leads progress through the sales cycle. Remember, broad match can increase traffic but may bring in unrelated clicks, so it’s essential to have a robust negative keyword list in place. This list prevents your ad from showing for certain search terms, enhancing relevance.

The Pitfall of match types: Some advertisers inadvertently under utilise the potential of match types, either due to a lack of awareness or not dedicating time to comprehend their mechanics. This oversight can lead to ads appearing for a myriad of irrelevant or just partially relevant searches with a low conversion rate, squandering the campaign budget.

Broad match type works best when Google Ads offline conversion tracking is setup by integrating with your CRM.

What Are Negative Keywords?

Negative keywords allow you to exclude search terms from your campaigns. When you add a term as a negative keyword, your ad won’t show for any searches that include that term. This ensures you’re not spending money on irrelevant clicks and helps target your ads to the most suitable audience.

Why are they crucial for Mortgage Brokers?

Mortgage brokers operate in a niche market with specific clientele. Without the use of negative keywords, ads might appear for searches that are irrelevant to their services, leading to wasted budget and lower ROI.

Examples for Mortgage Brokers:

- “Mortgage jobs” or “Mortgage careers” – Someone looking for jobs or careers in the mortgage industry is not looking to get a mortgage.

- “Mortgage calculator” – While related, someone looking for a calculator might not be ready for a broker’s services yet.

- “Mortgage fraud” – This is a topic you’d want to steer clear from.

- “Mortgage history” – This could relate to academic or historical research about mortgages, rather than seeking broker services.

- “Free mortgage advice” – If you don’t offer free advice, this negative keyword can prevent those looking for free services from clicking on your ad.

Using Online Conversion Tracking in Google Ads

Google ads Online conversion tracking is a powerful tool that lets advertisers measure the effectiveness of their ad campaigns in real time. It provides insights into what happens after a user interacts with your ad—whether they make a purchase, sign up for a newsletter, call your business, or perform any other valuable action.

How Does It Work?

- Tracking Setup:

You begin by adding a small piece of code (often referred to as a “pixel” or “tag”) to your website. This code is generated by Google Ads. - User Interaction:

When a user clicks on your ad and then takes a defined action on your site, such as completing a contact form or making a purchase, the code triggers and records a conversion. - Data Collection:

This data is then sent back to your Google Ads account, where you can analyse conversion rates, understand which ads are most effective, and optimise your ad spend based on real results.

Why It’s Important for the Broker Industry:

- Lead Generation: Brokers, whether they’re in real estate, finance, or any other sector, rely heavily on generating leads. With conversion tracking, brokers can see which ads are driving potential clients to take actions like filling out contact forms, requesting quotes, or booking appointments.

- ROI Measurement: Brokers often operate with strict budgets. By understanding which ads lead to conversions, brokers can allocate their budget more effectively, ensuring they’re spending money on ads that provide the best return on investment.

- Optimisation: Conversion tracking data becomes pivotal for Google’s Smart Bidding strategies, allowing real-time bid adjustments for optimal results. Moreover, by feeding accurate conversion information to Google’s machine learning algorithms, advertisers empower the system to identify patterns, predict user behaviours, and suggest dynamic campaign adjustments. For brokers, this not only ensures efficient ad spend but also provides data-driven insights, granting them a competitive edge in a saturated market.

- Understanding Client Behaviour: By observing which actions potential clients take after clicking on an ad, brokers can gain insights into their preferences and pain points. This can inform not just advertising strategy, but also service offerings and client communication approaches.

Conversion tracking in Google Ads is not just a technical tool—it’s a window into the customer journey. For industries like brokerage, where the competition is fierce and every lead is precious, leveraging this tool effectively can be the difference between an ad campaign that burns money and one that brings invaluable clients.

Offline Conversion Tracking: Improving Lead Quality

Offline conversion tracking elevates the way businesses assess the impact of their online advertising campaigns. By integrating this method, companies can delve beyond the initial online interactions to uncover the deeper value of leads and the genuine revenue they generate.

While many companies are content-measuring success with surface-level metrics such as completed forms, a truly effective evaluation digs deeper into the sales funnel of your lead pipeline to determine lead quality. It becomes vital to hone in on metrics like cost per sales qualified lead, cost per quote, and cost per customer to achieve a clear understanding of return on investment. After all, it’s these lower funnel events that provide a genuine indicator of an ad campaign’s performance.

Pioneering businesses recognise the merits of integrating their Customer Relationship Management (CRM) systems with advertising platforms. This synergy permits a continuous flow of data, capturing and tracking online leads throughout their journey in the sales cycle. Rather than limiting evaluations to the inception point – the filled-out online form – it’s pivotal to trace the evolution of leads. With offline conversion tracking, every touchpoint, from initial interest to final sale, can be connected to specific ad interactions.

Imagine a scenario: a potential customer engages with an online ad, fills in a contact form but finalises their purchase via a phone call or email This offline conversion – the actual sale – can be logged within the CRM with the revenue value, and this links back into Google Ads to the initial online ad campaign, offering a detailed and comprehensive picture of campaign efficacy.

By bridging online advertising efforts with real-world outcomes, offline conversion tracking presents a 360-degree view of marketing strategies. It goes further by permitting businesses to refine their strategies to target higher-quality leads. This involves prioritising leads that transcend just the initial form completion, ensuring that subsequent marketing efforts are informed, effective, and focused on quality over mere quantity.

Targeting with Audiences: Enhancing Precision in Google Ads

Audiences represent a pivotal dimension in Google Ads targeting, offering advertisers the means to pinpoint their messaging based on user behaviour, interests, and demographics. While keyword targeting hones in on user search intent, audience targeting seeks to understand the user behind those searches, making your campaigns more contextually relevant and tailored.

Audience Targeting:

Beyond mere keywords, Google Ads facilitates brokers in defining their audience based on an array of parameters, including demographics, geographical areas, interests, and the like. For instance, a broker specialising in mortgages for first-time buyers might hone in on a younger demographic, whilst one focusing on luxury estates might target audiences within higher income brackets.

On the Google Search Network, audiences can be seamlessly layered atop keyword targeting. This combination allows for a more granular approach: not only are you targeting based on what users are actively searching for, but also who these users are and their online behaviour patterns. For instance, an advertiser can aim their ads at users who’ve previously visited their website (remarketing) while they’re searching for related keywords. This dual-targeting strategy can significantly amplify ad relevance and potential conversion rates.

In addition to the Search Network, Google’s vast ecosystem encompasses platforms like the Google Display Network and YouTube, among other properties. Each of these platforms offers unique audience targeting opportunities.

In essence, leveraging audiences in Google Ads means transcending traditional keyword-centric approaches. It’s about crafting a narrative that aligns with the user’s journey, ensuring that your messaging resonates at every touchpoint, be it on a search result page, a blog, or even a video stream. By understanding and utilising audience targeting, advertisers stand to create more meaningful connections and achieve better campaign outcomes.

Diving into Performance Max Campaign Type:

Performance Max is Google’s unified campaign offering that sprawls across various platforms: Google Search, Google Display, and YouTube. It has its distinct advantages and potential pitfalls, which we’ll delve deeper into later in this guide.

At its core, Performance Max is most effectively utilised when integrated with a robust CRM system. The primary reason for this recommendation is the opportunity it affords advertisers to focus on deeper funnel conversion events, beyond the basic metrics of initial form submissions or quotes. For example, you can tailor your strategy to prioritise Sales Qualified Leads (SQL), actual sales quotes, or even track leads that eventually culminate in a sale. By aligning your ad spend with tangible business outcomes, you ensure a more ROI-focused advertising approach.

Creating Ads

Before launching any advertising campaign, it’s crucial to have a clear understanding of your business offerings. What sets you apart in the crowded market of mortgage brokers? To capture the attention of potential clients, it’s imperative to define and articulate your unique value proposition.

Begin by evaluating your unique selling points. Reflect on what makes your services distinctive. Why have your existing clients choose you over other mortgage brokers? Delve deep into these considerations. The insights derived will not only shape your value proposition but also influence the compelling benefits you highlight in your ads.

Creating your ad requires a personal touch. Although Google offers the flexibility of up to 15 headlines and 4 descriptions, it’s essential to curate these thoughtfully. While Google can juggle these elements to create combinations, the onus is on you to pin specific headlines and descriptions, ensuring they capture your core message accurately

Bear in mind that your ad won’t be alone. It will share the Google search results page with possibly six other ads. This crowded space means your ad needs to shine brighter, captivating searchers to click on your offering rather than a competitor’s. Differentiating yourself is key.

Having multiple versions of an ad in each ad group is a smart approach. This allows for split-testing, ensuring you continually refine to find the most effective message. The heart of your ad should revolve around your service’s key benefits, unique selling propositions, any ongoing promotions, and standout features. And, to drive interaction, always include a persuasive call-to-action, be it in the headline or the description.

Optimising Landing Pages for Conversions:

Your landing pages are crucial in converting visitors into leads. Even with a meticulously crafted Google Ads campaign targeting your ideal customer profile, its efficacy hinges on the quality of your landing pages. They should ideally be on par with, if not better than, your competitors.

Simply directing all your Google Ads traffic to your homepage is a missed opportunity. Instead, craft specific landing pages tailored to individual keywords. For instance, if you’re targeting “first-time mortgage buyers,” your landing page should directly address their concerns and needs. This ensures the content is always pertinent to the visitor, substantially increasing the likelihood of a conversion.

If your website isn’t adept at creating effective landing pages, consider utilising specialised tools designed for creating high-converting pages. Key elements every landing page should encompass include:

1. Compelling Value Proposition: Clearly articulate the unique value you offer with clear and compelling Headlines. Your main headline should grab attention immediately and convey the primary benefit of your offering.

2. Relevant and High-Quality Imagery: Use visuals that resonate with your audience and reinforce the purpose of the page.

3. Concise and Persuasive Content: Ensure your copy is straightforward and drives home your value proposition, eliminating any fluff.

4. Consistent Branding: Ensure your landing page aligns with your brand colours, fonts, and overall voice for a seamless experience.

5. Trust Signals: Feature testimonials, reviews, or trust badges to build credibility and reduce user apprehension.

6. Mobile Optimisation: Ensure your landing page looks and functions flawlessly across devices, especially on mobiles.

7. Speedy Load Times: A delay of even a second can lead to lost conversions. Prioritise quick page loads for the best user experience.

8. Straightforward Call-to-Action (CTA): CTAs should be prominently placed, and their wording should make the desired action clear.

9. Minimal Distractions: Limit the number of links or extraneous information. Keep the user focused on the primary objective.

10. Communicating the offer: Clear actionable headlines and descriptions

11. Test and Tweak Regularly: Continually A/B test different elements of your landing page to determine what maximises conversions.

Strong Call-to-Action and Engaging Lead Magnets:

Beyond compelling CTAs like “Book a Free Consultation” or “Get a Free Assessment,” an effective lead magnet can bolster your credibility. By presenting you as a knowledgeable figure in your field, it fosters trust among potential clients, making them more inclined to seek your expertise for their mortgage needs. Once you’ve captured a visitor’s email address, strategic follow-up emails can keep you top-of-mind, ensuring they think of you when they’re ready to move forward.

Re-market to your website visitors

Remarketing ads, often referred to as retargeting ads, are visual prompts—be they images or videos—that appear across the internet. Their primary objective is to entice previous website visitors back to your site. The rationale is simple: while a user may not have engaged or converted during their initial visit, a gentle reminder might motivate them to return and take action. By incorporating remarketing strategies within your Google Ads account, you’re essentially giving your business another opportunity to secure an enquiry from those initial non-converters.

Tips for Mortgage Brokers using Google Ads

The efficacy of Google Ads for mortgage brokers is underpinned by a combination of relevance, control, and demonstrable results. Here’s a tailored guide for mortgage brokers in the UK to leverage Google Ads:

Determine Your Campaign Objective:

– Select no objective, or Leads objective..

– “Call to Action. This motivates potential house buyers to take action, also known as a conversion, be it filling out a form or making an enquiry.

Select Your Campaign Type:

– Aim: Decide the sort of Google Ads campaign you’d like to launch.

– Recommendation: The “Search” campaign. It’s ideal for targeting individuals actively seeking mortgage-related services online.

Budgeting for Success:

– Steer clear of indirect competitors like banks and building societies.

– Set a daily budget between £20-£60 initially.

– Setting an inadequate budget can restrict your reach to potential mortgage leads.

Bidding:

– Manual Bidding: Offers granular control at the keyword level and the best starting option

– Automated Bidding: After your campaign starts doing well, and is getting conversions every day or week, change over to target CPA bidding.

Geo-Targeting with Precision:

– Utilise the “Locations” feature to demarcate areas you service: cities, towns, postcodes, etc.

– Prefer “people in, or who regularly visit, your targeted locations” for precision.

Don’ts:

– Spending on locations outside your service ambit.

Scheduling Your Ads:

– Given the B2C nature of mortgages, prospective home buyers search all day. Thus, ensure your ads are active 24/7 to maximise visibility.

Crafting Persuasive Ad Texts:

– Clearly delineate your unique selling points from competitors – Emphasize your distinct advantages.

– Culminate with a compelling call to action, like “Arrange a Free Consultation” or “Secure Your Mortgage Quote Now”.

Keyword Research for Relevance:

– Dedicate time to learn the search terms your potential clients use.

– Incorporate these keywords to ensure your ad emerges for the most germane searches.

Employing Negative Keywords:

– Exclude extraneous terms to avoid your ad cropping up in unrelated queries. For mortgage brokers, examples could be “banks”, “holiday homes”, or “mortgage calculators”.

Optimising Your Landing Page:

– Ensure your ad’s landing page aligns with the searcher’s intent.

– Highlight a clear call to action, details about your offerings, and easily reachable contact information.

When orchestrated meticulously, Google Ads campaigns can be pivotal in propelling mortgage brokers ahead of their UK competitors, and securing a consistent inflow of high-quality leads.

Conclusion

In the intricate digital landscape of the UK mortgage market, a carefully devised and methodically executed Google Ads campaign can be a transformative tool for mortgage brokers. By harnessing the platform’s power of relevance, control, and tangible results, brokers can effectively reach out to their target demographic and convert them into valuable leads. From pinpointing the ideal campaign objective and judiciously allocating budgets, to mastering bidding strategies and ensuring landing pages resonate with prospective clients, every step requires meticulous attention to detail.

Furthermore, the incorporation of a strong call to action, judicious keyword selection, and strategic geo-targeting enhances the campaign’s efficacy. To cap it all, the beauty of Google Ads lies in its adaptability, allowing campaigns to evolve based on performance data. For mortgage brokers in the UK, mastering Google Ads can be a ticket to unprecedented growth and success, setting them distinctly apart in a competitive market. It’s more than just about visibility; it’s about making meaningful connections with those seeking your expertise. Armed with the insights from this guide, brokers are well-equipped to navigate the digital advertising realm confidently and proficiently.