In today’s competitive digital landscape, accounting firms face the challenge of standing out and attracting high-quality clients. Google Ads offers a powerful solution, allowing accountants to connect with potential clients precisely when they are searching for accountancy services. By effectively leveraging Google Ads, accounting firms can significantly enhance their online visibility, drive targeted traffic to their websites, and convert visitors into long-term clients.

This guide will walk you through the process of setting up and optimising Google Ads campaigns specifically designed for accounting services, helping you maximise your advertising budget and achieve measurable results. Whether your goal is to generate more leads or improve lead quality, we’ll provide practical strategies to unlock the full potential of Google Ads and grow your accountancy firm. We’ll also explore long-standing advertising best practices, along with the latest strategies to fully harness the power of Google Ads AI

Why Should Accountants Use Google Ads?

Google Ads helps accounting firms target potential clients based on search behaviour, location, and intent. Google Ads enables accounting firms to drive traffic, generate leads, and grow their business in a targeted, cost-effective way. Here’s why it’s essential for accountants:

Targeted Client Acquisition Google Ads allows you to show ads to people actively searching for accounting services, ensuring your firm connects with the right clients at the right time.

Increased Website Traffic A well-optimised campaign boosts website traffic by attracting people already interested in accounting services, driving more qualified visitors to your site.

High-Quality Lead Generation By targeting specific accounting needs, Google Ads helps generate valuable leads from businesses and individuals seeking your expertise.

Enhanced Brand Visibility Consistent ad placements increase your brand’s visibility in competitive markets, keeping your firm top-of-mind for potential clients.

Cost-Effective and Measurable Google Ads’ pay-per-click model and robust analytics let you measure ROI and optimise campaigns to make the most of your advertising budget.

Local Targeting Target clients within your service area using location-based ads, ensuring you reach the right local audience who need accounting services.

AI-Driven Optimisation Google Ads’ AI features, like Smart Bidding, automatically optimise your campaigns for better performance, helping you attract more qualified leads effortlessly.

Getting Started with Google Ads for Accountants

Here are the key steps designed to help accountants get started with Google Ads, offering step-by-step instructions on how to create and optimise campaigns that will deliver measurable results. Whether you’re new to online advertising or looking to enhance your current efforts, following these strategies will enable you to effectively leverage Google Ads and position your accounting firm for digital success.

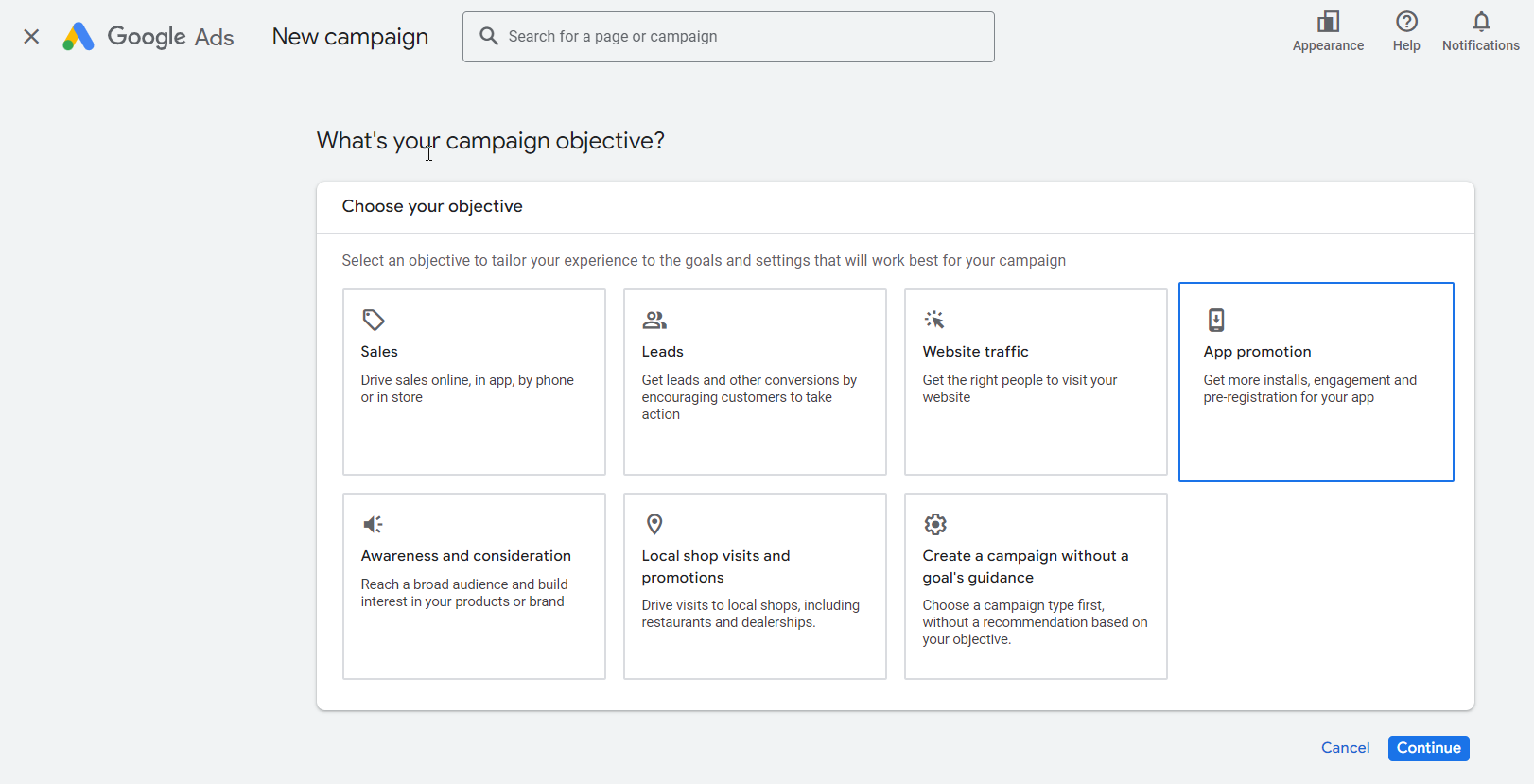

1. Setting Clear Campaign Goals

Before configuring your Google Ads campaign, it’s essential to clearly define your campaign goals. Establishing specific objectives will shape your overall strategy, enhance your targeting efforts, test advertising assets such as copy and imagery, and provide a foundation for measuring success.

In Google Ads, each campaign must have a single primary goal and corresponding bid optimisation strategy. By focusing on a specific goal—such as driving website traffic, generating leads, or increasing sales—you can ensure your campaign is tailored to achieve the desired results. The bid optimisation strategy you choose should align with this goal, whether it’s maximising clicks, conversions, or return on ad spend (ROAS).

For accounting firms, these goals typically align with key business outcomes, such as:

Increasing Phone Enquiries: Encourage prospects to reach out for consultations or further inquiries by phone.

Online Quote Requests: Motivate potential clients to submit enquiry forms.

Measuring Cost Per Lead: Set a consistent cost per lead for a desired quantity of leads.

Tracking Lead Value: Go beyond cost per lead by recording sales revenue within Google Ads through a POS system (e.g., Stripe) or CRM. Optimise your campaigns toward sales revenue rather than just CPA.

Promoting Specific Services: Highlight offerings such as audits, tax preparation, or business advisory services, directing visitors to specific service pages like tax planning, payroll, or bookkeeping.

By defining these objectives upfront, you can make informed decisions about targeting, ad copy, budgeting, and performance metrics to ensure your campaign delivers meaningful results for your accounting practice.

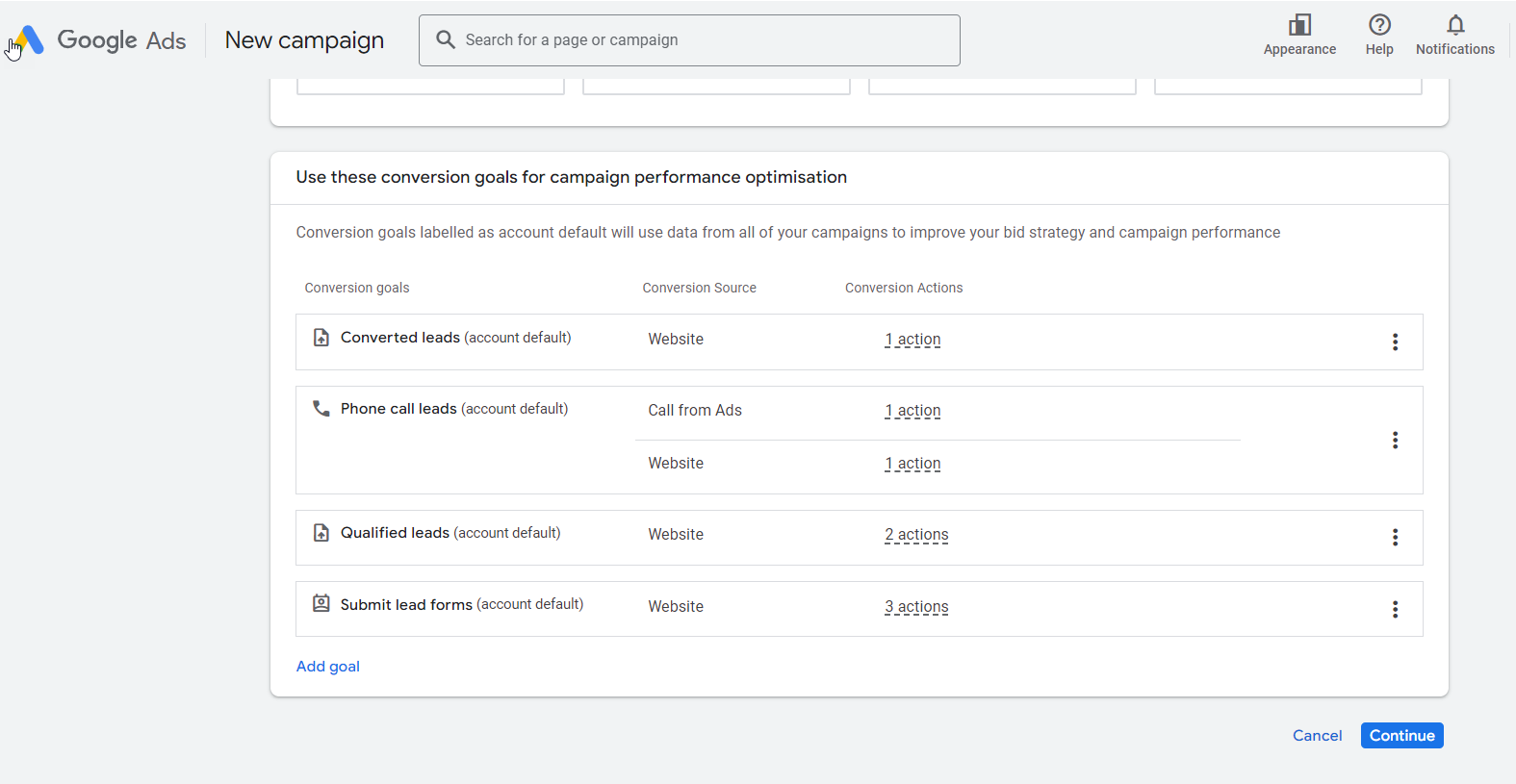

2. Set Up Conversion Tracking to Measure Success

To measure the success of your Google Ads campaigns, it’s essential to set up conversion tracking which enables you to measure and report on which keywords, ads, and landing pages are driving the most conversions. This insight allows you to refine your campaigns and allocate your budget more effectively, ensuring better returns on investment (ROI).

For accountants, common conversion actions may include:

- Phone calls from ads or directly from your website.

- Form submissions on your website for consultations or inquiries.

- Offline conversions such as lead cycle changes for lead scoring or sales revenue reporting.

Phone Call Tracking

In the accounting industry, phone calls are often a primary method for generating leads, particularly for urgent or high-value services like tax advice or financial audits. To track phone calls as conversions, you can use:

- Call Extensions and Click-to-Call Ads: Track calls directly from your Google Ads when users click the call button.

- Website Call Tracking: Install a tracking script on your website to capture phone calls made after a user visits through an ad.

By tracking phone calls, you gain insights into the volume of leads coming through this channel and can optimise your campaigns based on this data. Given that phone leads often have a higher conversion rate in accounting, this is a key metric to monitor.

Form Submissions Tracking

Contact form submissions are another critical conversion for accountants, as many potential clients prefer to request consultations or further information through a website form. Setting up conversion tracking for form submissions ensures that you can:

- Capture all leads coming through your site.

- Measure which ad campaigns and keywords are leading to the most inquiries.

Ongoing Optimisation and Refinement

Conversion tracking provides the foundation for continuous improvement.

By continuously refining your campaigns based on conversion insights, you’ll drive better outcomes, enhance your overall marketing efficiency, and ultimately grow your accounting business.

Whether it’s tweaking your keyword strategy, refining your ad messaging, or reallocating your budget to high-performing locations, a data-driven approach will help you achieve higher conversion rates and improved ROI.

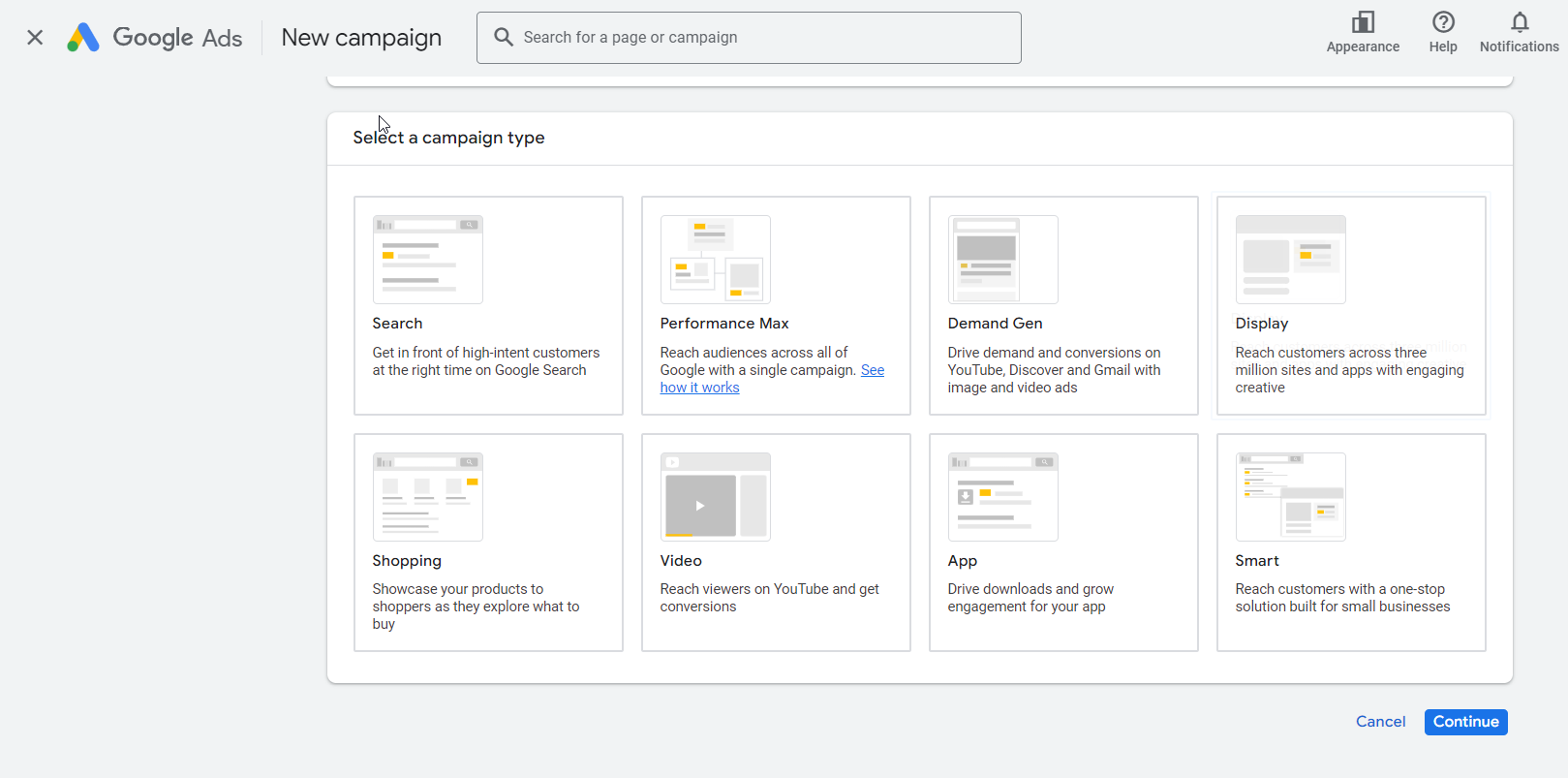

3. Choosing the Right Campaign Type

Google Ads offers several campaign types, but not all are equally suited to accountants. The most effective options for accountants include:

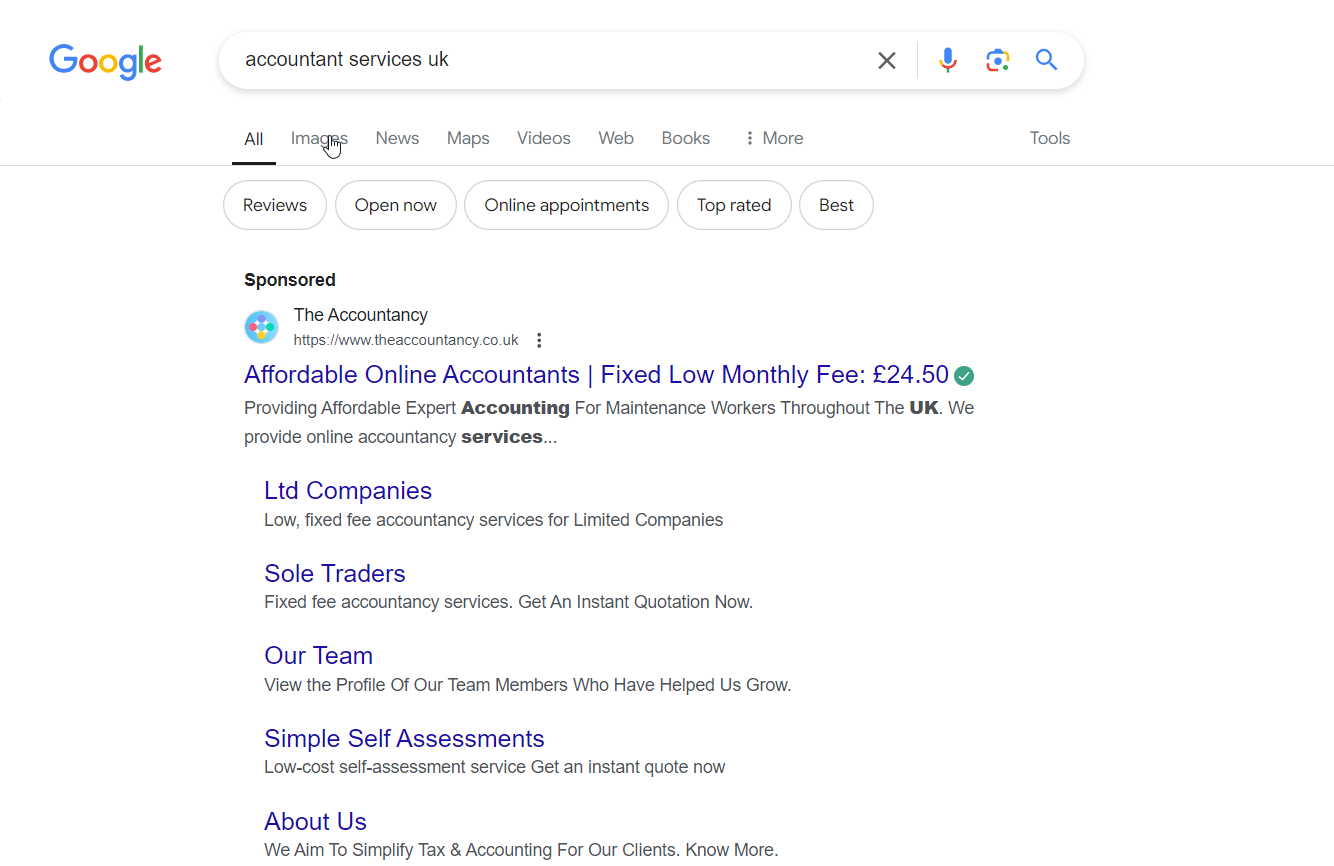

- Search Campaigns: These ads appear in Google search results when potential clients search for relevant accounting services, such as “accountant near me” or “tax planning advice.” This is the best choice for reaching people actively looking for services.

- Local Services Ads: If your practice serves a particular geographical area, this option allows you to target local clients and make it easier for them to contact you directly. These ads appear at the top of Google search results. They do provide less control than Search campaigns, but useful as a starting point.

- Display Campaigns: These ads appear on websites within the Google Display Network. For accountants, we recommend just starting with remarketing to staying top-of-mind with previous website visitors.

4. Defining Your Target Audience

Effective audience targeting is essential for maximising the impact of your Google Ads campaigns while minimising wasted ad spend. Targeting the right prospects ensures that your ads are reaching people who are actively seeking accounting services.

When running Google Ads campaigns, it’s essential to identify where you can compete effectively. Avoid broad, high-competition keywords like “accounting software” that large software companies such as Sage or Xero might target. Instead, focus on niche keywords that directly relate to your services and location, such as:

- “Southampton tax accountants”

- “Chartered accountant for small businesses”

This approach helps you avoid unnecessary competition and ensures your ads are shown to more relevant prospects at the bottom of the marketing funnel who are closer to making a decision. We shall discuss targeting methods next.

5. Keyword Research and Selection

Choosing the right keywords is the cornerstone of a successful Google Ads campaign. Strategic keyword selection helps you maximise the efficiency of your budget, avoid irrelevant clicks, and connect with high-quality prospects. Targeting the most relevant search terms entered into Google ensures that your ads are shown to users who are actively seeking your services.

Some high-performing keywords for accountants include: “Accountant near me” “Tax preparation services” “Small business accountant” “accountancy firm” “Chartered accountant company”. Lets run through the steps to research and select the best list of keywords to focus on.

Identify Your Key Services

Start by defining the specific accounting services you want to promote, such as tax preparation, bookkeeping, payroll, year-end accounts, or VAT filing. This focus will help guide your keyword choices, ensuring they are highly relevant to the services you offer.

For example:

- “Tax return accountant” for individuals seeking help with filing taxes.

- “Small business payroll services” for companies looking to outsource payroll management.

Emphasise Commercial Intent

Keywords that demonstrate commercial intent are more likely to attract the most qualified prospects ready to engage your services. Avoid generic or purely informational keywords such as single words like accountancy and accounting. Instead, focus on terms that signal a strong intent to hire an accountant.

For instance:

- “Accountancy firm near me” and “tax preparation services” are stronger than vague terms like “accountancy” or “tax preparation,” which may attract users seeking information rather than professional services.

- “VAT return accountant” or “business tax services” indicate that the user is searching for actionable help, not just research.

By focusing on commercial intent, you’ll attract leads who are more likely to convert into clients.

Location Keywords:

Incorporate location modifiers in your keywords to signal your local presence. For example, use keywords like “accountant Southampton,” “tax adviser Southampton,” or “bookkeeper Southampton.” This helps ensure that your ads are shown to users searching for accounting services in your specific area.

Include “near me” modifiers in your keywords to capture users who are actively seeking accounting services in their vicinity. Keywords such as “accountant near me” or “tax adviser near me” can help you connect with prospects who are geographically close to your office, increasing the likelihood of conversion.

Focus on Professional, Specific Terms

When selecting keywords, choose terms that emphasise the professional nature of your services. Use precise terms that reflect the expertise of your practice, such as:

- “Chartered accountant” instead of just “accountant.”

- “Bookkeeper for small businesses” rather than “bookkeeping help.”

- E.g. Accountancy, company, accountancy practice etc.

This approach not only makes your ads more relevant but also helps attract the right prospects who are actively seeking professional services rather than general information.

Leverage Google’s Keyword Planner

Google’s Keyword Planner is an invaluable tool for generating relevant keywords and understanding their potential. The planner provides data on search volume, competition, and keyword trends, helping you identify which keywords will drive the best results for your campaign.

- Discover new keyword opportunities based on your core services.

- Evaluate search volumes to focus on high-impact keywords.

- Understand the competition for each term, helping you avoid keywords dominated by larger firms or software providers like Sage, Xero, or QuickBooks.

Understand Keyword Match Type

Keyword match types are essential in determining how closely a search term must match a keyword in your Google Ads account. They range from broad match, which displays ads for loosely related search terms, to exact match, where ads are shown only for terms very close to your chosen keyword. Understanding these match types and their impact is critical to ensuring your ads reach the most relevant audience.

Additionally, as Google Ads increasingly incorporates AI, the scope of match types has expanded, allowing for broader interpretations of search intent. For a deeper dive into this topic, check out our blog post: The Evolving Nature of Keyword Match Types.

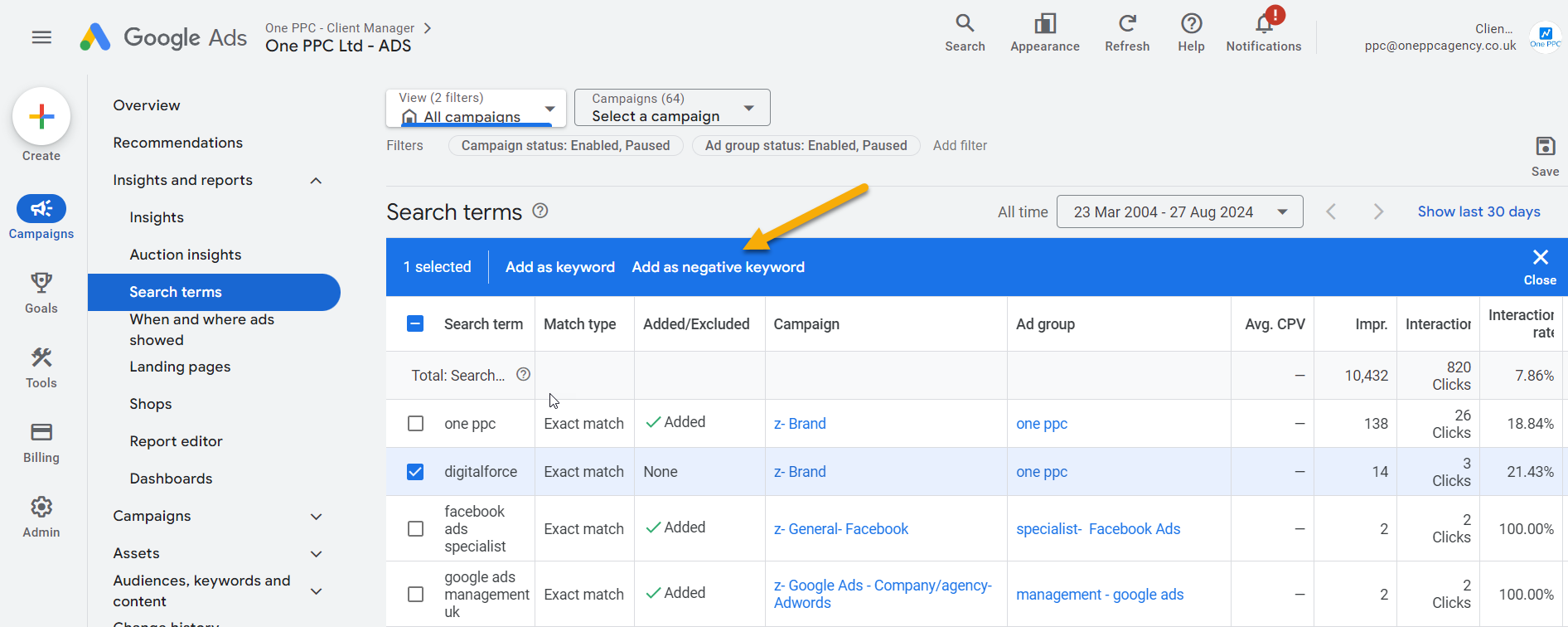

6. Utilise Negative Keywords

Negative keywords are essential for avoiding irrelevant traffic and reducing wasted spend. For accountants, irrelevant searches might include keywords related to training, education, or DIY accounting. Add negative keywords such as:

- “accounting jobs”

- “free accounting software”

- “accounting courses”

By implementing these strategies, accountants can ensure that their Google Ads campaigns are tailored to attract relevant prospects while minimising wasted ad spend on irrelevant clicks. Take advantage of the search terms report and regularly update your negative keyword list to refine your targeting and optimise campaign performance.

To learn more about negative keywords you can read our blog post ultimate guide to negative keywords.

How to do Negative Keyword Research

Identify Irrelevant Terms: Start by identifying keywords that are not relevant to your accounting services. These may include terms like “jobs,” “training,” “career,” “apprenticeship,” as well as software-related terms like “software” and “SAAS.” These keywords indicate that the user’s intent is not aligned with your services and can be blocked as negative keywords.

Run Search Term Reports: Regularly review the search terms report in your Google Ads account. This report provides insights into the actual search terms that triggered your ads. Look for any terms that are unrelated to your services or attracting irrelevant clicks. Add these terms as negative keywords to prevent your ads from showing to users with no purchase intent.

Consider Location-Specific Negative Keywords: If you operate within a specific location, consider adding other cities that you do not target as negative keywords. For example, if you provide accounting services in London, you may want to exclude terms like “accountants in Manchester” or “accountants in Birmingham” to avoid attracting users looking for services outside your targeted area.. To do this, the single word negative of the city name will block any searches that contain that city name.

Ongoing Refinement: Continuously monitor and refine your negative keyword list based on new search terms or trends that emerge. Regularly review your search terms report and keep an eye on industry-specific keywords that may be attracting unwanted traffic. By staying proactive and adjusting your negative keyword strategy, you can continually improve the quality of your ad impressions.

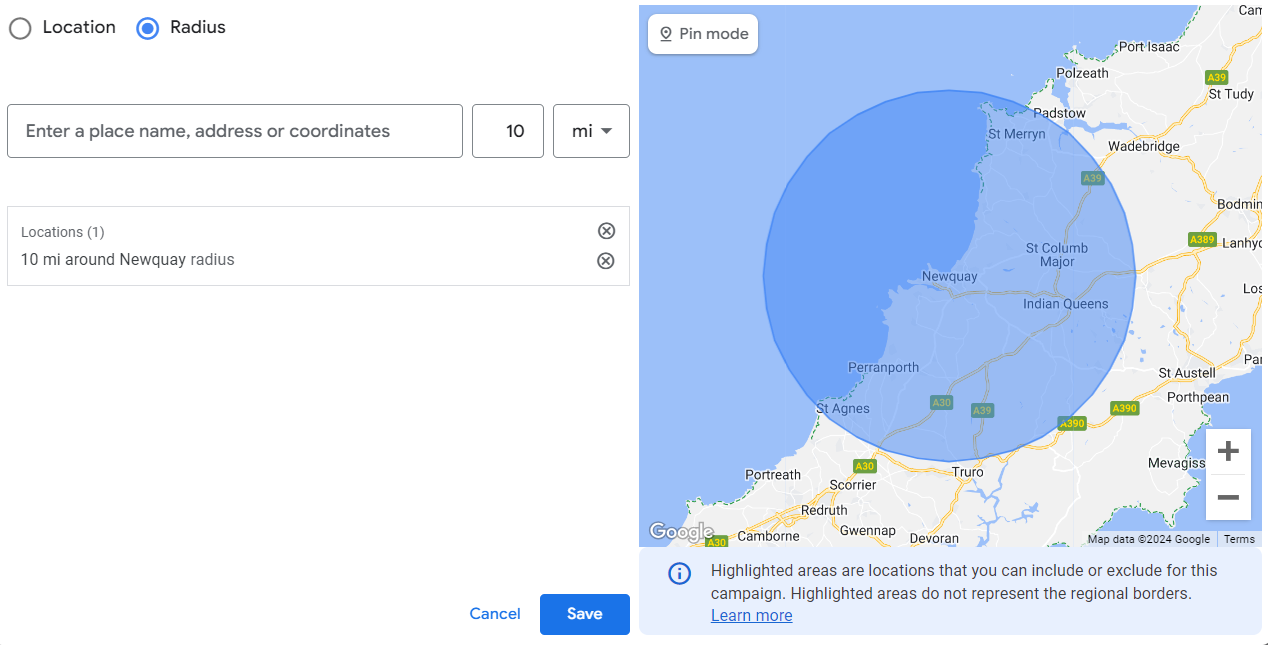

7. Location Targeting

The conversion rate is usually higher for local-based service providers, especially when it is advantageous to meet face to face, so targeting the right geographical area is vital. For example, if your practice is based in Southampton, it would be wise to start by targeting searches like “accountants in Southampton” rather than broader terms like “UK accountants,” which may will attract lower converting traffic.

Whilst it’s true that accountants may have clients nationwide or even international, when it comes to advertising, starting with a focus on local areas is generally more effective. As you expand your budget, you can gradually broaden your targeting radius. By narrowing down the competition, you can specifically target prospects who are searching for accountants in their own city or town.:

This local focus will help you avoid unnecessary competition with large, national firms. Google Ads allows you to:

Focus on a specific radius around your office or service area, showing ads to potential clients nearby.

Target by city or region, ensuring your ads reach users in the areas where you offer services.

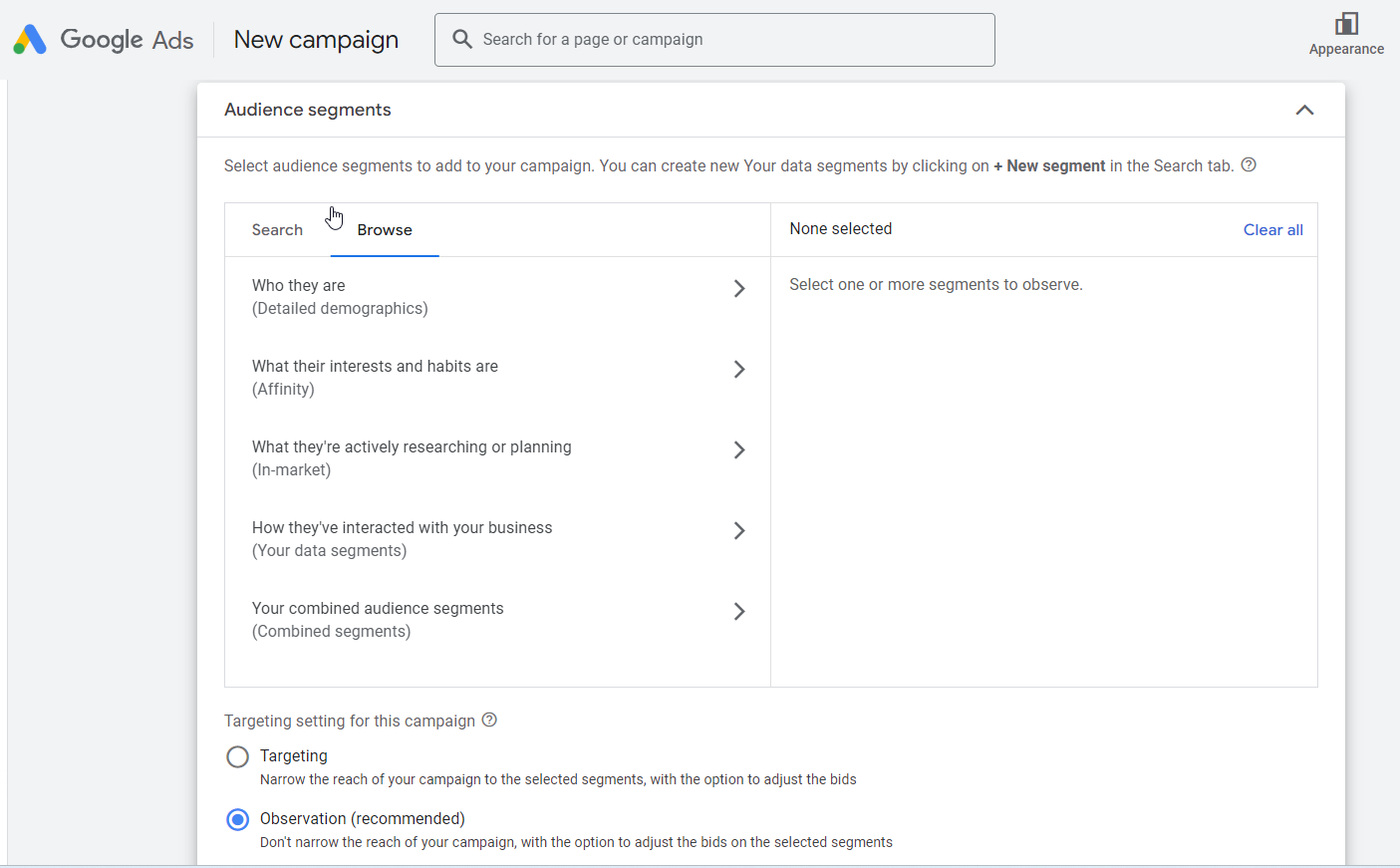

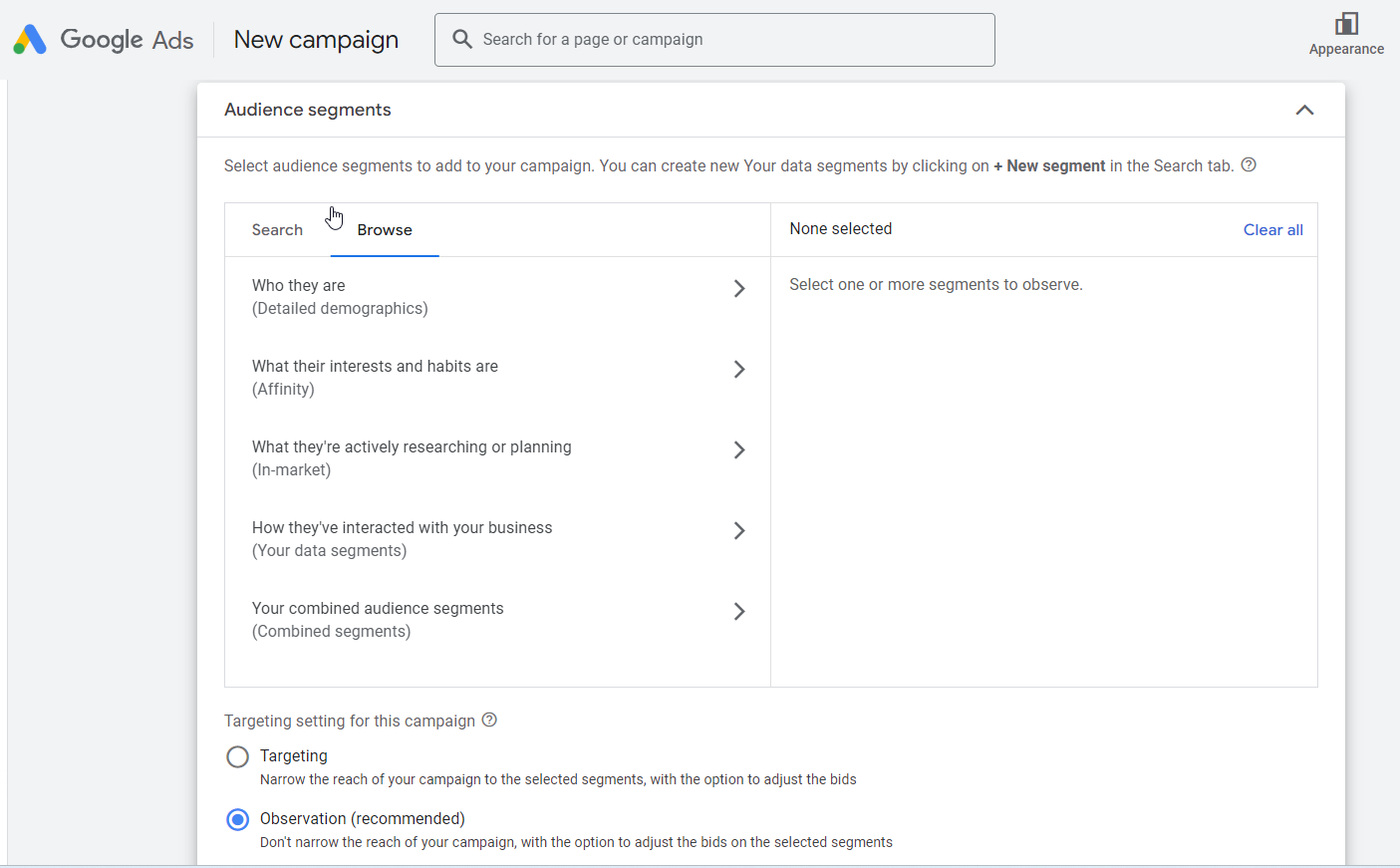

8. Audience Targeting

Audience targeting enables you to reach cold traffic—individuals who may be unfamiliar with your brand but have shown interest in the accounting industry as they browse the web.

Additionally, you can retarget previous website visitors or your existing contact database, including data from your CRM or finance POS, to engage those who have already interacted with your business.

Cold Traffic:

In addition to other targeting options such as keywords, Google Ads offers various audience targeting options that can help you refine your approach even further. For accountants, this might include targeting based on:

Business size or industry to attract clients who fit your ideal customer profile (e.g., small business owners versus mid-market or enterprise).

Display behaviour to reach users who have recently looked for accounting or financial services.

Using these filters, you can narrow your audience to highly qualified prospects, ensuring your ads are reaching people most likely to convert.

Warm Traffic (First-Party Data):

First-party data targeting is highly effective, allowing for more precise and personalised campaigns that can significantly boost conversion rates. For accountants, remarketing is a key strategy to re-engage users who have visited your website but haven’t yet converted. By showing tailored ads to these prospects as they browse other websites or return to Google, you keep your firm top of mind and increase the likelihood of turning them into clients.

For example, if a potential client visited your tax services page but didn’t contact you, you can display ads offering a free consultation on tax planning, encouraging them to take action.

To maximise the value of your existing customer data, sync your CRM, POS, or spreadsheets with Google Ads. This enables you to:

Target existing clients or leads with personalised offers, upsells, or follow-up campaigns.

Create Custom Audiences based on your first-party data to reach individuals who have already shown interest in your services or are at different stages of their customer journey.

This data-driven approach ensures your ads are more relevant, increasing the chances of conversion and strengthening client relationships.

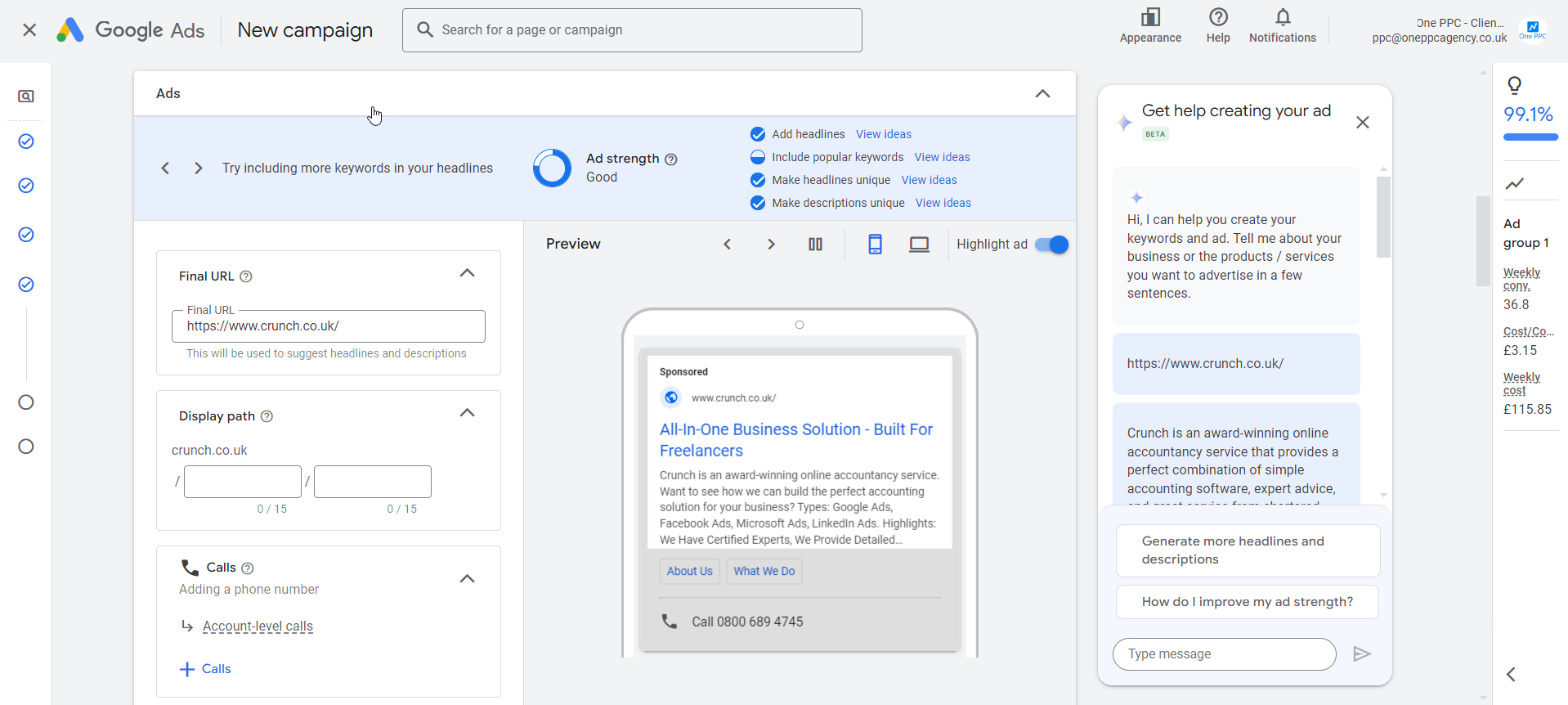

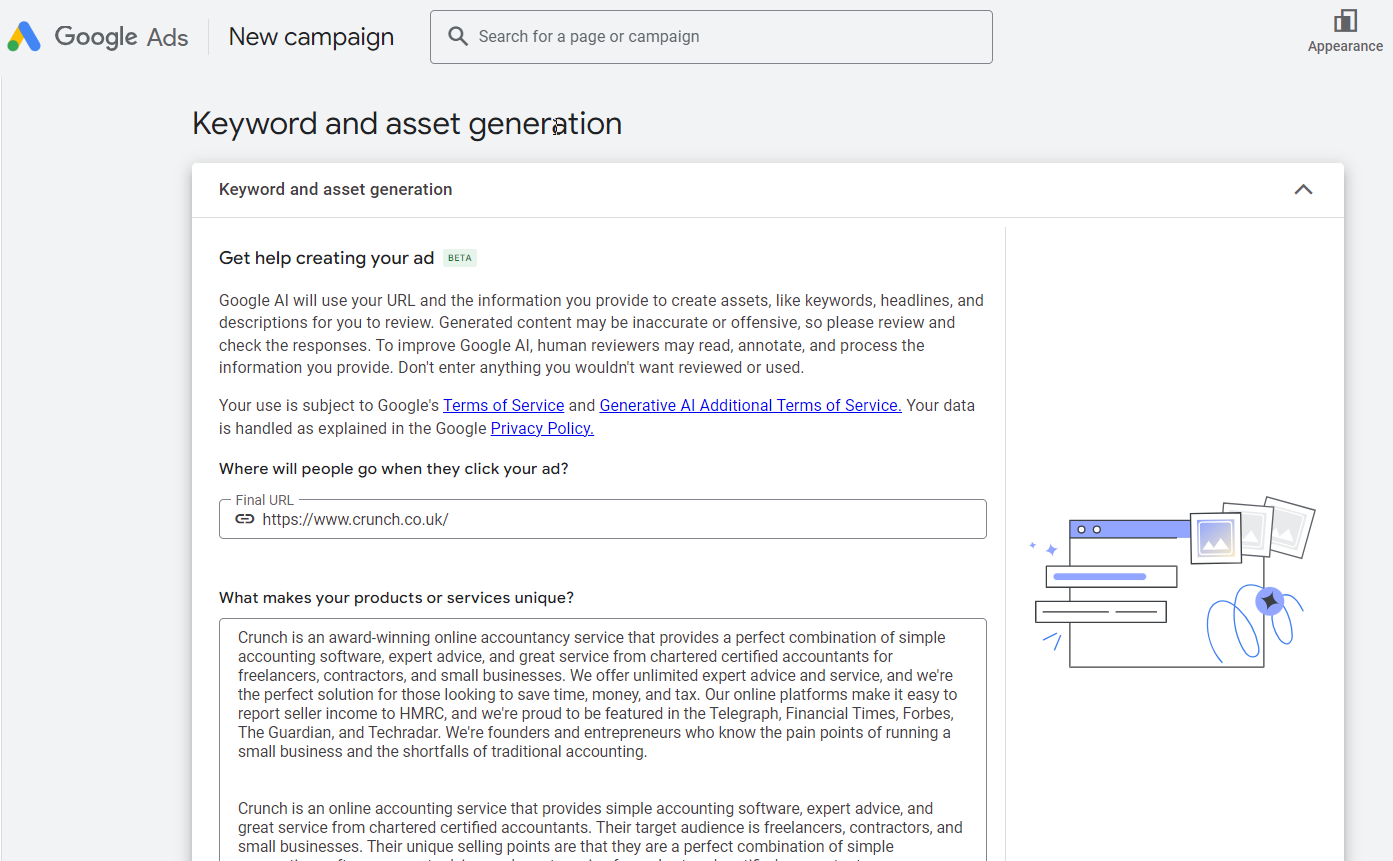

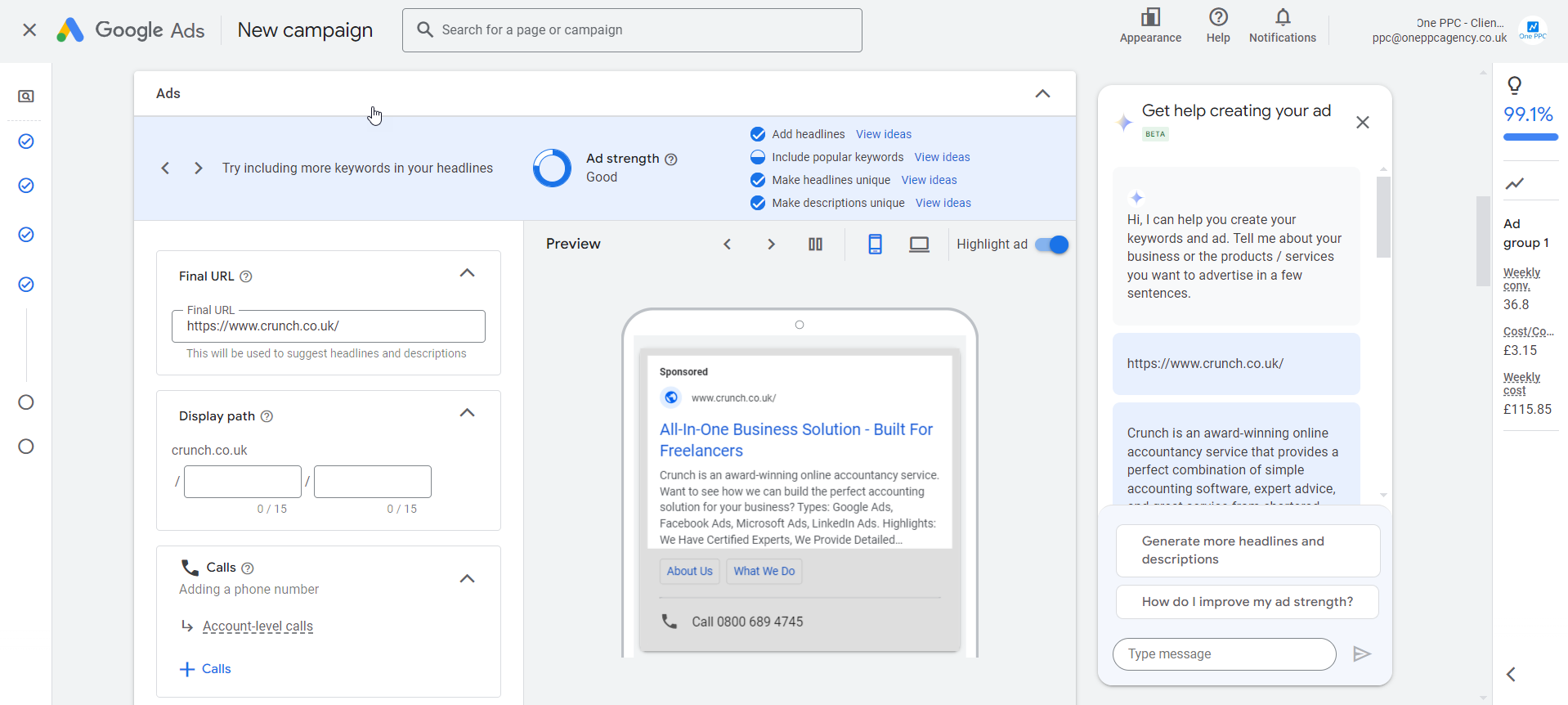

9. Crafting Compelling Ad Copy

Creating effective ad copy for your Google Ads campaigns is crucial for grabbing the attention of potential clients and driving conversions. As an accountant, you need to showcase your expertise, build trust, and communicate the value you provide, all while standing out in a competitive marketplace.

When crafting ad copy for your accounting services, it’s essential to align your messaging with the needs of your target audience and the keywords they are searching for. A well-crafted ad not only grabs attention but also conveys trustworthiness, expertise, and value. Here are key strategies to optimise your ad copy and attract more qualified leads:

Highlight Your Unique Selling Points (USPs)

Differentiate your accounting firm by emphasising what sets you apart. Whether you specialise in tax planning, VAT returns, business audits, or another area of accounting, make sure this is clear in your ad copy. Clients are more likely to engage with services tailored to their specific needs. Clearly communicate why prospects should choose your firm over competitors. Highlight benefits such as personalised service, years of experience, or industry-specific expertise

For example:

- “Specialised in Small Business Tax Audits”

- “Expert VAT Return Filing for Local Businesses”

- “Over 15 Years of Expertise in Small Business Accounting”

- “Personalised Tax Solutions for Contractors and Freelancers”

Make your value proposition clear to help potential clients understand the benefits of working with your firm.

Incorporate Strong Call-to-Actions (CTAs)

Your ad should guide potential clients toward taking immediate action. Use compelling CTAs that prompt prospects to contact you, book a consultation, or learn more about your services. Examples of effective CTAs include:

- “Book a Free Consultation Today”

- “Call for Expert Tax Advice”

- “Speak to a Chartered Accountant Now”

A strong CTA increases click-through rates and helps convert interested users into leads.

Leverage Localisation

If your services cater to a specific region or town, include the location in your ad copy to attract local clients. This adds relevance and builds trust with people searching for nearby services.

Examples:

- “Trusted Accounting Services in [Town/City Name]”

- “Top-Rated Accountant in [Town/City Name]”

Localising your ad copy makes it more appealing to nearby prospects and improves the likelihood of engagement.

Utilise Google My Business and Ad Extensions

To enhance your ad’s visibility and offer additional information, make use of Google My Business and ad extensions:

- Location Extensions: Show your office address, phone number, and map link directly below your ad. This helps clients find you easily and increases the chances of direct engagement.

- Call Extensions: Add your phone number, enabling mobile users to call you with one click.

- Sitelink Extensions: Include links to specific service pages, such as tax preparation or payroll services, for users to explore more about your offerings.

These ad extensions increase the relevance of your ads and provide easy ways for clients to contact or learn more about you.

A/B Test Your Ad Variations

A/B testing (split testing) allows you to experiment with different ad elements to see what resonates best with your target audience. Create variations of your ads by changing:

- Headlines and descriptions

- Call-to-action phrases

- Keywords or promotions

- Tone of voice (formal vs. conversational)

For example, test whether “Speak to an Expert Accountant Today” performs better than “Get a Free Consultation Now.” Regularly reviewing the data from these tests will help refine your ads based on real performance insights.

Use Relevant Keywords within Ad Copy

Mention Offers or Promotions

If you offer any special deals, such as free consultations or discounted rates, make sure to feature them prominently in your ad copy. Offers add value and provide an incentive for prospects to engage with your services.

For example:

- “Free Initial Consultation for New Clients”

- “Get 20% Off Your First Year-End Tax Review”

Promotions can increase click-through rates and create a sense of urgency.

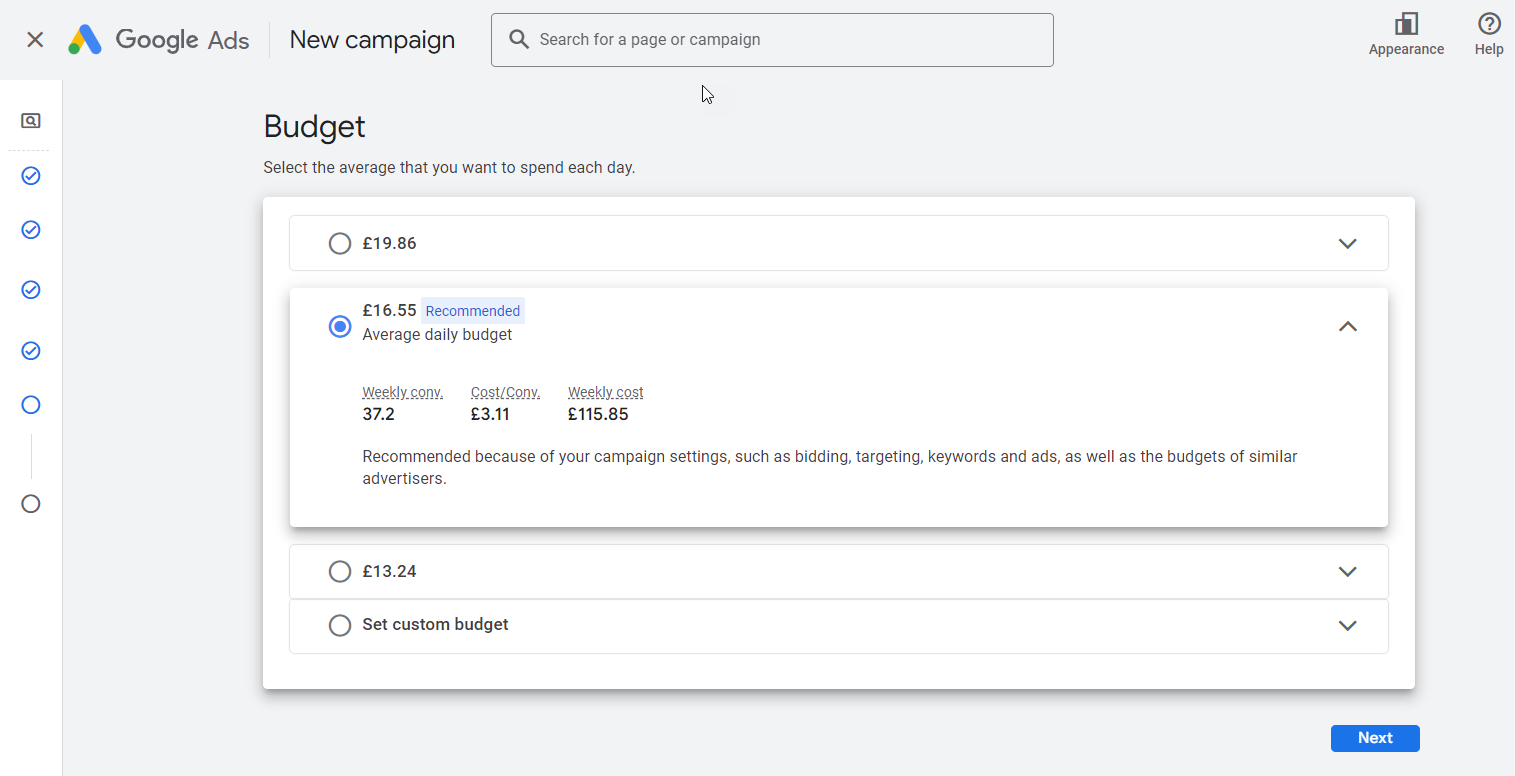

10. Setting Your Budget

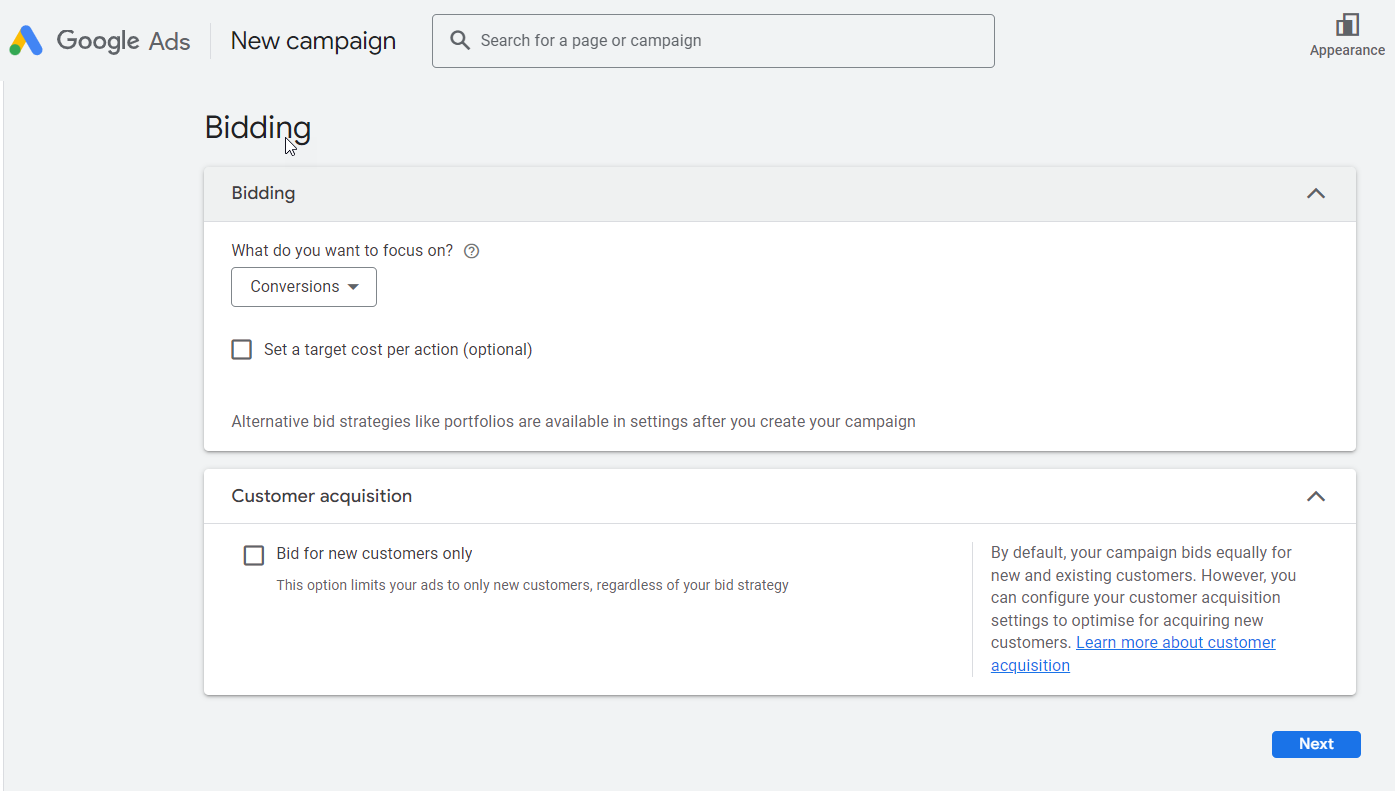

11. Bidding Strategies

Your bidding strategy should align with your campaign goals. Some strategies to consider:

- Maximise Clicks: If you aim to drive traffic to your website and introduce new potential clients to your services.

- Maximise Conversions: Focus on generating specific actions, such as inquiries or bookings.

- Target CPA (Cost per Acquisition): If you want to control the cost per lead or client acquisition.

- Smart Bidding: Google’s AI-driven bid strategies can optimise your bids automatically based on historical performance, improving results over time.

12. Landing Pages

Creating dedicated landing pages for each service you offer is a powerful strategy to enhance your Google Ads campaigns as an accountant. By providing specific landing pages for individual services, such as Tax, Year End, and Payroll, you can create a more tailored and personalised experience for your prospects. Here are some key benefits and tips to consider:

Improved Relevance: Dedicated landing pages allow you to align your ad copy and landing page content more closely with the specific service being promoted. This increases relevance and provides a seamless user experience. When users click on your ad, they land on a page that directly addresses their needs, increasing the likelihood of conversion.

Clear Call-to-Action: Each landing page should have a clear and compelling call-to-action related to the specific service being offered. Whether it’s a “Contact Us” form, a phone number to call, or a free consultation offer, ensure that the call-to-action is prominent and encourages visitors to take the desired action.

Highlight Unique Selling Points: Use your landing pages to highlight the unique benefits and features of each service. Explain how your expertise in Tax, Year End, or Payroll sets you apart from competitors. Include testimonials, case studies, or client success stories to build trust and credibility.

Optimise for Conversion: Design your landing pages with a focus on conversion. Ensure that they load quickly, are mobile-friendly, and have a user-friendly layout. Clear headings, bullet points, and concise copy can help users quickly understand the value you offer and take action.

Consistent Branding: Maintain consistent branding across all landing pages to reinforce your brand identity and create a cohesive experience for visitors. Use your logo, colours, and visual elements that align with your brand guidelines.

Track and Analyse Performance: Implement conversion tracking and analytics to monitor the performance of each landing page. Analyse key metrics such as bounce rate, time on page, and conversion rate to identify areas for improvement. Continually test different elements, such as headlines, imagery, or form placements, to optimise your landing pages for better results.

13. Test, Analyse, and Adjust

Once your Google Ads campaign is live, regularly monitor its performance. Look at metrics such as click-through rate (CTR), conversion rate, and cost per acquisition (CPA) to understand which aspects of your campaign are performing well and which need improvement.

Run A/B tests to experiment with different ad copy, landing pages, or bidding strategies. This will help you fine-tune your campaigns for maximum ROI.

Common Mistakes to Avoid in Google Ads for Accountants

- Overly Broad Targeting: While it may be tempting to target a wide audience, narrow down your targeting to specific locations and industries for better lead quality.

- Not Using Negative Keywords: Failing to exclude irrelevant keywords can waste ad spend and result in low-quality leads.

- Ignoring Landing Page Optimisation: Ensure that your landing pages are designed to convert visitors, with clear CTAs and relevant information related to your ads.

Conclusion

In conclusion, the digital era has transformed the way accountants attract and retain clients, with Google Ads emerging as a vital tool for success. From crafting compelling ad copy to precise audience targeting and keyword optimisation, mastering the intricacies of Google Ads can significantly impact your firm’s growth and client acquisition.

While the platform offers powerful opportunities to connect with prospects actively seeking accounting services, success hinges on a strategic, well-executed approach. Implementing tailored campaigns that resonate with your audience, carefully selecting the right keyword strategies, and continuously refining your ads based on performance data are all crucial steps in achieving exceptional results.

By applying the strategies detailed in this guide, accountants can elevate their digital marketing efforts, enhance brand visibility, and generate high-quality leads. In an industry where competition is increasingly fierce, Google Ads provides the competitive edge needed to thrive. Embrace this tool with confidence, and you’ll position your firm for sustained growth and long-term success in the ever-evolving digital landscape.